Running a business from home vs working from home, and how it relates to your rental agreement.

The start of the pandemic in 2019 saw many people being forced to work from home, and two years on many people are still working remotely as companies have found the dynamic to be resource-efficient and convenient. However the shift from a corporate environment to a residential one poses an important question regarding operating a business from a rented property. (See also how companies support remote working in lieu of the pandemic, leading to more people relocating to Cape Town).

Recently, we have had to investigate our own lease agreements in relation to Body Corporate rules and zoning laws. We have also had to refer to insurance policies, as the type of work performed at home may raise risks and premiums.

In particular, our lease states that, “The Tenant is entitled to use the Premises for private residential purposes only.” This statement has brought up the following question:

“What if I work from home?”

To protect your business, this article serves as a word of caution and source of information.

What kind of work can you perform from home?

Working from a laptop or PC can be indistinguishable from personal use in many cases. Home owners and tenants are responsible for their own electricity charges and Wi-Fi fees, and noise generated is no louder than usual conversational volume. While a vague example, this type of remote work would usually not pose an inconvenience to neighbours or be resource-intensive in a manner that affects others. (Compare home office activities to a manufacturer of goods who may put strain on drainage systems or home power outlets).

Zoning laws and their consequences

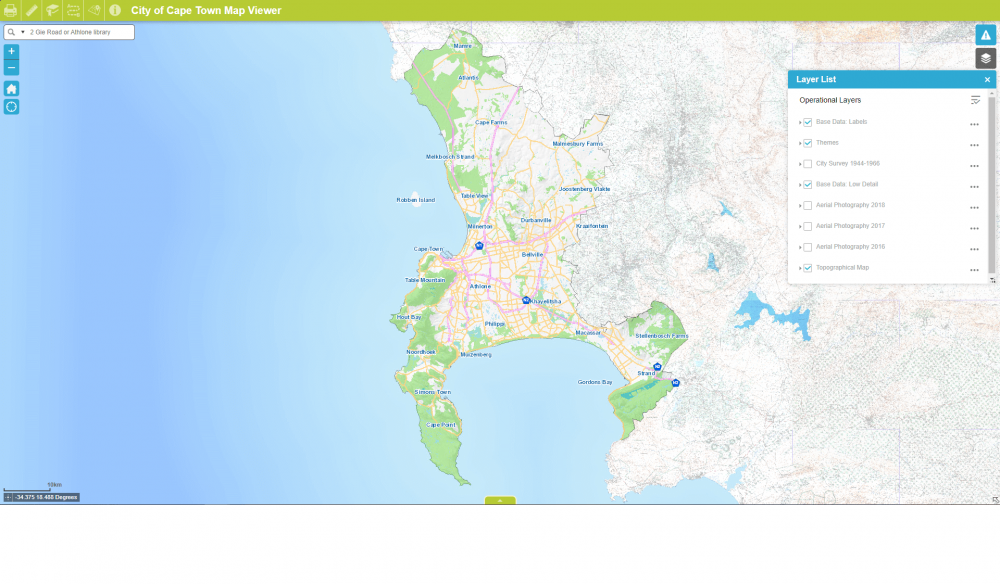

Where legality and enterprise clash is zoning laws. The City of Cape Town has an online portal that can be used to check your property’s zone and a zone guide has been created to stipulate the allowed activities on your property. Your first port of call is to check that your specific business type is allowed in your zone.

For example, in General Residential Sub-Zone 1 (Group Housing), occupants are limited to operating a home child care business. In comparison, General Residential Sub-Zones 2-6 are allowed to use the premises as a place of worship, hotel, and conference facility.

The next step would be to check your more local authorities: the Body Corporate or Home Owner’s Association, and your lease.

Body Corporate & HoA rules

If you live in a complex, you will no doubt have a Body Corporate or HoA and be expected to follow a set of rules set out by one of these organisations, as well as the lease. Upon occupancy, you would have been asked to sign the Code of Conduct that outlines what is and is not allowed within that complex.

Sectional Title Solutions has further examined the Sectional Titles Schemes Management Act and clarified:

Thus, if the unit you bought or looking to buy is registered as a residential unit in the relevant sectional title scheme, no business may be run from that unit. It is not all doom and gloom, provided that with the written consent of all owners in the sectional title scheme, a residential section or exclusive use area may be used for the purpose of running a business as consented to.

In terms of our lease, tenants are most definitely allowed to perform work activities on their devices in lieu of working in an office. Many tenants have also had to start side businesses to compensate for income lost as a result of Covid-19. Where the line is drawn and investigation required is when a business contradicts either zoning laws or sectional title codes of conduct.

Implications for the Landlord

A landlord’s insurance premiums may be affected if a tenant is using a residential property to run a business. Commercial or business insurance differs from residential insurance for a reason – the types of properties have different potential risks and will require specific coverage. Zones are often in place to protect the value of an area, particularly if it is otherwise uninhabited by other businesses. Many zones allow for a combination of residences and businesses, but others strictly prohibit this crossover.

A final word

Our primary concern is to protect the property, the tenants, and its landlords. Most zoning laws and codes of conduct have the same aim, which is why we align our lease with these in mind. Despite this, as rental agents, home owners and previous renters, we offer our clients support should enquire about the possibility of running a business from home.

FAQs:

If you wish to run a business from a rented property, you must first consult your lease. Should the lease not prohibit this, you should check your Body Corporate rules (where appropriate) as well as the zoning for your property.

You will need to check your zone first to check which businesses are permitted to function on your property. If your business type is not allowed in your zone, the owner would need to apply for rezoning.

The cost to rezone is dependent on the size of the property, but generally costs several thousands of Rand. This document outlines the costs involved in rezoning a property.

Legally speaking, if your property falls within a zone that allows your type of business, and you are not in contravention of your lease or Body Corporate rules, your home business may not use more than 25% of your residential property’s space.

A garage may fall under this percentage, depending on the size of the rest of the property.

The City of Cape Town has an online portal that allows citizens to look up their address and view their zone.

Residential properties are taxed and insured differently to commercial properties. If you would like to use a residential property for commercial activities, the property will need to be rezoned officially.